Thousands of retirees are paying more tax than necessary because they haven’t received basic advice to switch their super into the tax-free retirement phase.

The Super Members Council (SMC) found that around 700,000 Australians over 65 who aren't working full-time still have an accumulation (savings-phase) account.

This means retirees could be paying an extra $650 in taxes each year on average. Altogether, they have $90 billion in accumulation accounts.

If someone keeps $100,000 in an accumulation account instead of moving it to a pension account, they could pay an up to extra $4,500 in super taxes over their retirement. For $200,000 balances, the extra tax could be $9,000.

Some inactive accounts belong to people who are still working and adding to other accounts or keeping an accumulation account as a backup. However, research shows many people don't act because they are disengaged or don't know what to do.

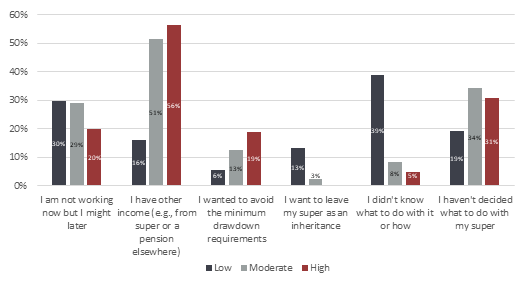

A consumer survey of retirees found about 6 in 10 Australians with lower balance (less than $100,000) who have an inactive account keep it because they haven’t decided what to do with super yet or don’t know what to do with their account.

Super Members Council CEO Misha Schubert said Delivering Better Financial Outcomes financial advice reforms will be crucial to help retirees access quality information at low cost.

“Not knowing enough about super can lead to poor decisions, like leaving accounts inactive or withdrawing funds without proper planning.”

"Making simple information and advice available to more Australians is a big missing piece of the retirement puzzle. The coming financial advice reforms will help make advice more affordable."

“The package of reforms will enable the 2.5 million Australians on the runway to retirement to get the high-quality information they need to plan wisely at a much lower cost – and we urge Government to introduce legislation swiftly.”

For retirees with low balances (less than $100,000), the main reason for leaving funds in the accumulation phase is because they don’t know what to do with it or how (39 per cent).

This is the group that would most benefit from super funds being able to offer simple and affordable advice relating to their retirement income, as a detailed financial plan may be too costly.

Only 17% of Australians – and just 26% of current retirees – say they have sought financial advice from their super fund. Research shows 4 in 5 Australians aged 45–54 need financial advice but cannot afford it.

The Australian Government announced further details of its Delivering Better Financial Outcomes package but is yet to be legislated.

It allows super funds to better guide members at key life stages with personalised prompts to support them for retirement. It would also create a new type of adviser who can give simple but quality advice on APRA-regulated products.

Chart 1: Reasons for inactive accounts for retirees with low, moderate, and high balances

Notes: Question asks why individuals have left their super in accumulation and are not contributing to it. More than one reason can be selected. Reasons ‘Something else’ and ‘I don’t know’ have been excluded. Super balance range: low balances (less than $100k), moderate balances (between $100k and $400k) and high balances ($400k or greater).

Source: Susan Bell research commissioned by SMC, 2023.