Downsizers are using an unexpected boom market for houses during the Spring selling season to put money away for retirement and move into their new 'forever home' in an over 50s community.

Downsizing.com.au has spoken to a number of downsizers who’ve said they enjoyed fast sales and strong prices.

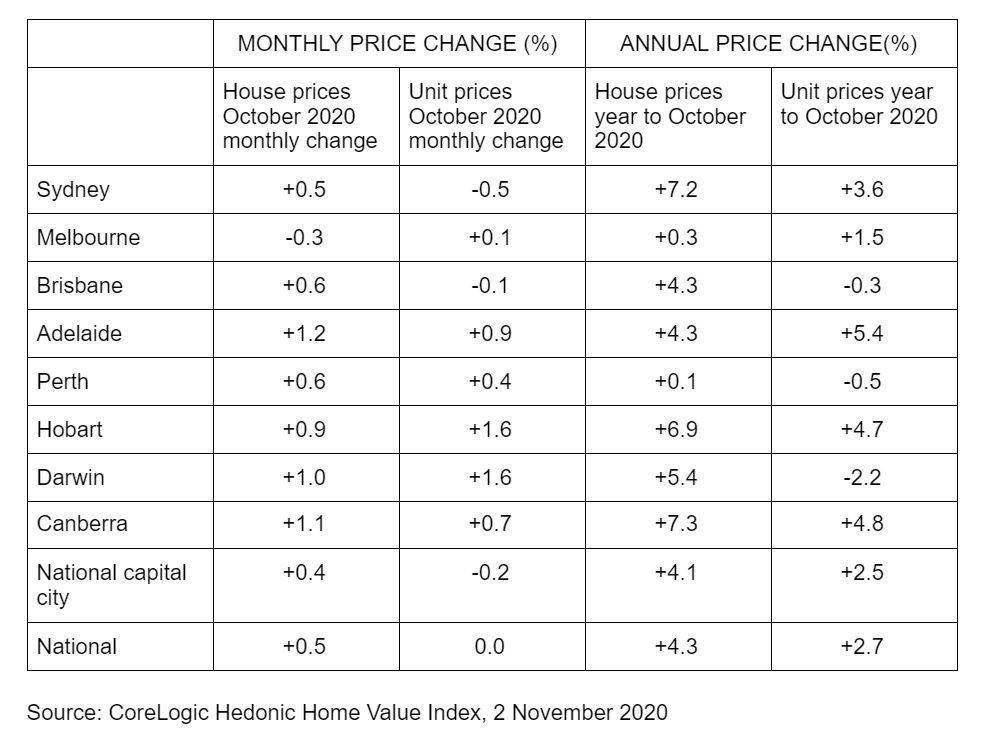

These downsizers are confirming new research which shows that house prices have strengthened, while unit prices have weakened, across Australia’s capital cities (see more on this below).

This is putting downsizers in the box seat in the market, given most are 'empty nesters' who are selling larger homes.

Kaye and Peter Jenkins, both in their 60s, sold their three bedroom property at Craigieburn, in Melbourne’s north, for $610,000, which was $30,000 above the reserve.

The Jenkins (pictured above) had 112 people inspect the property, along with five registered bidders at their 31 October auction.

They will be using the proceeds to move into a two bedroom home at the new Lifestyle Wollert land lease community, by Lifestyle Communities. It’s expected they’ll be shifting into the community around March next year.

“We don’t need a big home anymore so two bedrooms is just perfect for us,” Ms Jenkins said.

Apart from purchasing their new home, the Jenkins will also be able to use their home sale proceeds to top-up $30,000 into their superannuation and pay off other debts related to under-performing investment properties.

“Downsizing is the way to go to release equity,” Ms Jenkins said. “I say to my friends who are thinking about it - what are you waiting for?”

“We want to go for holidays, out to dinner, and have a new home and lifestyle, downsizing will help us do all that. What’s more, we don’t need to pay for the upkeep of our new home.”

Downsizing is the way to go to release equity - downsizer Kaye Jenkins

Mr Jenkins is a fitness instructor and is looking forward to using the gym and other fitness facilities at Lifestyle Wollert.

Meanwhile, Kim and Ian Robson sold their outer Brisbane acreage property for $1.1m in September just four days after signing a sales agreement with their real estate agent.

Given the strong result, the Robsons were able to purchase a $670,000 three bedroom retirement living unit at Village Yeronga, in inner Brisbane, rather than the two bedroom unit they had originally been considering.

In addition, they’ve been able to make a major contribution to their superannuation.

Ms Robson said she and her husband had brought forward their downsizing decision by three years, because of the uncertainty of the housing market next year and in following years.

“We’d been doing a lot of research but weren’t necessarily going to buy,” Ms Robson said.

“But after coronavirus hit, we brought forward our decision because we were frightened what the property market could do next year.”

One of the benefits of the Robsons downsizing move is that Mr Robson can cycle 4km to his rowing club, rather than the previous 30 minute car trip.

After coronavirus hit, we brought forward our decision - downsizer Kim Robson

Faye and Kevin Carey are empty nesters who, on 7 November, sold their four-bedroom house at Baulkham Hills, in Sydney's Hills District. They achieved a strong sale price of $1.205m. The Careys had lived in the house for an incredible 52 years and raised their three daughters there.

They have purchased a new two-bedroom retirement unit for $749,000 at the nearby Gracewood retirement living project by BaptistCare and in December will be moving in.

As self-funded retirees, the Careys were primarily motivated to move by the need to boost their retirement funds from downsizing, particularly given the lower or lack of dividends during the COVID-19 pandemic and ongoing low interest rates.

In addition, the Careys are looking forward to moving into a like-minded community (they already have some friends in the village) and seeing their existing house put to use by the young family that will be moving in.

The Gracewood project has been constructed over three stages, with the final stage being completed in June 2020. This stage includes 88 two or three-bedroom apartments, with additional community facilities like bocce court, fire pit and putting green adding to the previously existing facilities of a pool, community garden, gym, café and restaurant.

Divergence between house and unit prices

According to CoreLogic’s Head of Research, Tim Lawless, there is clear evidence that houses are currently out-performing units when it comes to sale prices.

“The rise in capital city housing values during October over the month was entirely attributable to a 0.4 per cent lift in house values which offset the 0.2 per cent fall in unit values,” Mr Lawless said.

“Almost two-thirds of Australian units are rented, and rental conditions have weakened, especially in the key inner city precincts of Melbourne and Sydney.

“These areas have a higher concentration of unit stock, and historic exposure to demand from overseas migration.

“Low levels of investment activity, relatively high supply of unit stock in inner-cities and international border closures are key factors that imply units will under-perform relative to houses over the medium term.”

FIND OUT MORE: