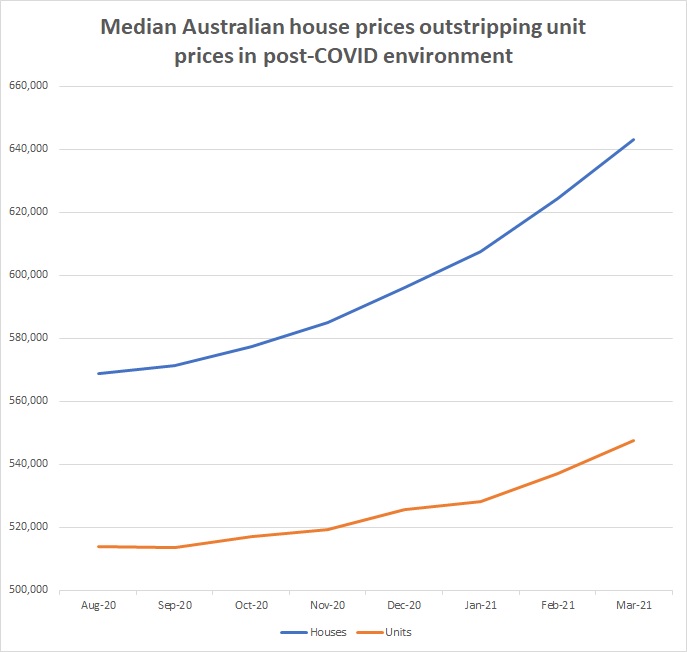

Australians have been given the perfect market opportunity to downsize with house prices surging by more than 13 per cent since the worst of COVID-19 - a growth rate nearly double that of units.

The CoreLogic monthly nationwide real estate report confirmed that Australian median house prices increased from $568,833 in August 2020 to $643,203 in March 2021, a rise of $74,370 or 13.07 per cent.

This compares to units, which increased by just 6.57 per cent over the same period.

This is good news for downsizers, many of whom are empty nesters who sell their family house to move into a retirement village, land lease community or other downsizing-friendly property such as townhouses, apartments or villas.

The buoyant market interest in houses means downsizers are finding it relatively easy to sell their property, while they are also achieving a high price which means they can top-up their retirement funds alongside purchasing a new home.

According to an analysis by Downsizing.com.au, the capital cities of Sydney, Perth, Canberra and Hobart have experienced the most impressive house price gains.

Between August and March, Sydney’s median house prices have jumped from $985,723 to $1,112,671, an increase of 12.88 per cent.

Perth’s house prices have risen from $461,891 to $527,833, a rise of 14.27 per cent, while Hobart’s house prices have increased from $517,877 to $584,974, a rise of 12.95 per cent.

The nation’s capital of Canberra has recorded the strongest house price gain in Australia, with a 14.42 per cent rise from $716,400 to $819,707.

According to real estate experts, the acceleration in house prices has been driven by low interest rates, a rising desire for spacious and more distant housing options in the post-COVID environment and expatriate workers returning to Australia from overseas with their families wanting to find homes.

Increased consumer inquiries for retirement living

Retirement Living Council executive director Ben Myers said the hot property market had generated an increased level of consumer inquiries to retirement living operators.

“People who may have put off thinking about a move are now thinking we should take advantage of this market,” Mr Myers said.

Mr Myers said the COVID-19 lockdown period had demonstrated the value of the retirement living sector and made it more attractive to people now looking at selling their home.

“Importantly, the COVID lockdowns actually allowed the retirement living industry to build its value proposition,” he said.

“If you are going to be locked down in a home in the suburbs you are going to worry about how you are going to get food and toilet paper, while there were lots of stories about retirement villages helping their residents in these areas.”

“In addition, the children of potential downsizers are now a lot more involved in the decision-making process, which operators are welcoming.

“Children are realising that retirement living communities are a great place for mum and dad, while in the past one of the big issues was that the family was not always part of the discussion.”

Comparative advantage of houses over units may not last forever

CoreLogic’s research director Tim Lawless said however that he expected unit prices to begin to catch up to houses.

“Lower density housing has continued to outpace higher density housing for capital gains,” Mr Lawless said. “Across the combined capitals, the quarterly growth rate for houses (6.5%) to March 2021 is more than double that of units (3.1%).

“Despite the underperformance, unit markets have turned a corner, with Sydney recording two consecutive months of rising values, while the Melbourne unit market has seen values consistently rising since October last year, with the trend accelerating over recent months.”

Last week, Downsizing.com.au released a report which showed that Australia’s booming housing market has made downsizing an increasingly lucrative tactic to help over 50s secure their financial future in retirement.

The average cash released from selling to downsize from a house to a retirement village in 2020 was $286,810. This compares to a cash release of $211,550 in 2015.

Comment from our CEO

Downsizing.com.au CEO Amanda Graham said: “This is the best time to downsize in the past 30 years, according to the property price data.”

“Many over 50’s still have a very large mortgage and this is a great opportunity to get rid of the mortgage, secure their financial position and upsize their lifestyle to suit this stage of life.”

Find out more

Downsizing.com.au has Australia’s best range of retirement and downsizing-friendly property - start your search here