Around one in four homeowners are planning to downsize in the next five years, as these owners seek to capitalise on strong property prices so they can enjoy an improved lifestyle, new research by a major bank has found.

The Westpac Bank research finds that 26 per cent of homeowners are currently planning to downsize, compared to 22 per cent who were planning to do so in November 2020.

The research follows similar insights from consumer research and advice company Digital Finance Analytics in June, which found there had been a 30 per cent surge in interest in downsizing in just one year.

Westpac’s Managing Director of Mortgages Anthony Hughes said: “In welcome news for buyers, the report found more people are now thinking about selling.”

This is largely being driven by confidence in getting a good return on their home, as well as an increasing desire to live in a new area as people seek more living space.”

In the year to 30 June 2021, CoreLogic reported that house prices had a median increase of 15.6 per cent, compared to a 6.8 per cent lift in unit values.

This is good news for downsizers, many of whom are ‘empty nesters’ who are selling a detached house.

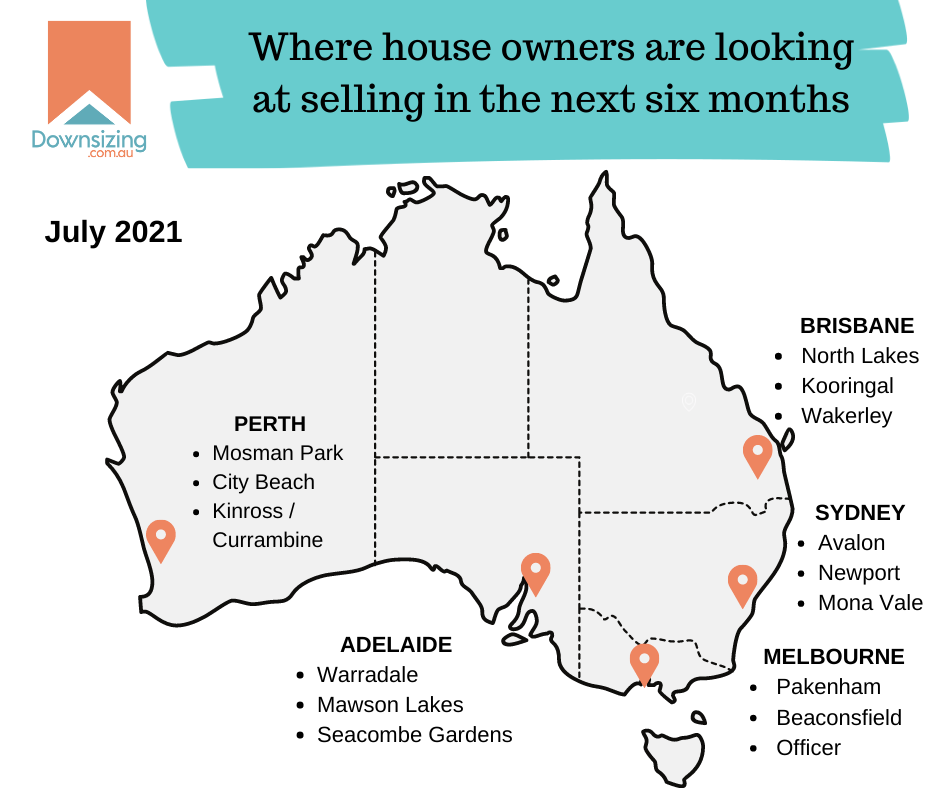

Westpac has also released a summary of the Australian suburbs where homeowners are most likely to list a property in the next six months.

In Sydney, the northern beaches suburbs of Avalon Beach, Newport and Mona Vale are the places where house owners are most likely to list a property.

In Melbourne, sellers are ready to sell their house in Pakenham, Beaconsfield and Officer, while in Brisbane the hot seller suburbs are North Lakes, Kooringal and Wakerley.

For a full list, see our map below:

Westpac’s “Likelihood to List” model was commissioned by Westpac and produced by Insight Data Solutions (IDS). The model considers elements such as property type, accumulated equity, and tenure in home, overlaid with local market data such as turnover, time on market and difference between listing and sale prices.

Comment from our CEO

Downsizing.com.au CEO Amanda Graham said the Westpac research was further evidence of growing popularity of downsizing during the COVID-19 pandemic.

“This is now the second major piece of research in a matter of weeks which has confirmed that more people are looking at downsizing. This makes sense during this time of upheaval, when people want to consolidate their finances and also seek an improved lifestyle,” Ms Graham said.

“The buoyant property market is driving consideration of releasing home equity, reducing any remaining mortgage, and moving into lifestyle-rich areas and communities for many potential sellers.”

Find out more

Downsizing.com.au has Australia's best range of over 50s property - start your search here